We have been riding on an unprecedented high for the past decade or so. That high reached its peak during the pandemic. Now, with inflation at a historic high, higher interest rate hikes are the main focus to cool it. And with that comes hesitation from buyers and sellers. So has the housing bubble burst? Here’s what you need to know!

If you’re South Asian, you’ve likely been told time and time again to save your money so that you can buy a house of your own. However, while SA families instill the value of saving money in their children, they don’t often teach them how to properly manage it. Nonetheless, owning a home or land is an honourable accomplishment and a major priority within the South Asian community that everyone is diligently encouraged to work toward.

In fact, according to the Vancouver Sun, there are approximately two million South Asian people in Canada and the likelihood of them purchasing a home is four times higher than the average Canadian. Meanwhile, in the United States, FrontAd Media notes that nearly 60% of South Asians have secured a home of their own.

That said, unless you’ve been living under a rock (which would probably be considered to be spacious and lovely in today’s market), you’ve likely heard about the housing challenges people across North America are facing.

However, while you may have heard about the issues plaguing hopeful homeowners, if you’re not entirely sure what it all means or how it might affect you, not to worry, we’ve got your back!

What’s going on in Canada?

Before we dive into the housing conversation, we need to set the stage and introduce the main character of this tale: inflation.

By now, you’re likely to be familiar with inflation and the fact that it’s quite high, which has impacted the costs of goods and services. The Bank of Canada uses the Consumer Price Index (CPI) to roughly calculate how much is being spent within each household for specific items, such as food, gas, housing, and more. When the costs associated with these items start to go up, this represents inflation of the CPI.

Prior to the pandemonium caused by the pandemic, simple pleasures, such as toilet paper, soap, bikes, and cold medication was relatively easy to come by at reasonable prices. And, at the time, the CPI was around 2%, which is where the Bank of Canada is seeking to get us back to. However, with the lockdowns that ensued both domestically and globally, people began to use their money (including the stimulus money the government pumped out to avoid a lengthy period of deflation) to purchase “…goods [rather than] in-person services,” explains the Bank of Canada. The pandemic, notes the Bank of Canada, coupled with the changes to consumer spending increased the demand for goods, but global supply chains just couldn’t keep up due to “…shipping bottlenecks and shortages of key [supplies],” which drove prices up.

To put it simply: when demand is high, but the supply is low, the prices are high.

Since 2020, the situation has worsened with inflation hitting its highest point in June 2022 at 8.1%, with the prices of both goods and services rising steadily. These increases were further exacerbated by the Organization of the Petroleum Exporting Countries (OPEC) cutting production of oil, which began in 2020, and has since driven prices up, with even steeper reductions slated for November 2022, highlights BBC. It costs money to transport goods and with the cost of oil rising due to less supply, higher transportation costs often get passed down to the consumer for companies to cover their expenses. As well, the Bank of Canada describes that the conflict between Russia and Ukraine, which began earlier this year, “…drove up the prices of commodities—particularly energy and agricultural goods —and created new disruptions to already impaired global supply chains.”

Say it with me: yikes!

Therefore, to correct the path that the economy is currently on and, ultimately get inflation under control, the Bank of Canada has stepped in to curb consumer spending. Beginning in March 2022, the Bank of Canada set about to do just that and has increased rates five times since, with the last change in September bringing the policy interest rate to 3.25%. An additional increase of .50% was announced on October 26, 2022, according to BNN Bloomberg.

These rising interest rates are making a lot of people nervous, particularly prospective homebuyers, who feel despondent about their chances of ever owning a home.

Similar to the demand for goods, there has been a high demand for houses for the last decade or so, which has steadily driven up the prices. In fact, Consolidated Credit Canada writes that over “…the last 20 years, home prices have gone up by 375% in Canada. In Toronto and Vancouver, the prices have increased by 450% and 490% respectively.”

Of course, there were a number of factors that played a role in driving the demand for housing, but these were two of the primary reasons: immigration and low interest rates.

Canada accepts approximately 300K immigrants annually, many of which have deep pockets. MSG notes that these individuals began buying up properties, many of which were rentals, subsequently increasing the competition between buyers in a market with limited supply. In addition, low interest rates made it easier for buyers to qualify for mortgages. Many people began to seek out properties, which resulted in bidding wars and conditions being waived to make offers more enticing. This heavy demand also contributed to the inflated prices of homes.

Here’s a professional opinion on the Canadian housing market:

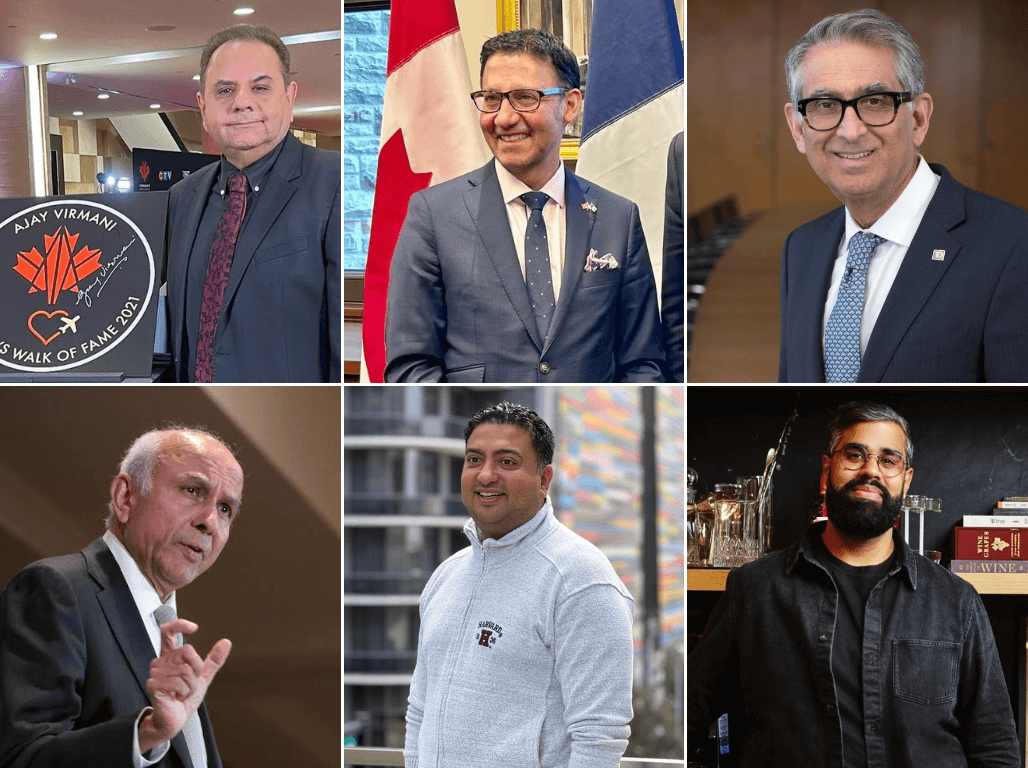

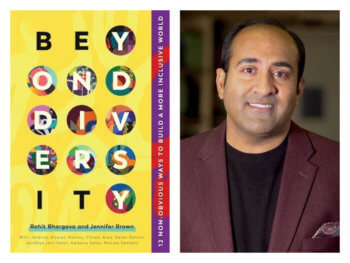

To speak more specifically on the Canadian housing market, I sat down with seasoned mortgage agent, Sas Gupta, of Funding Station, which he co-founded with Matthew Scida. The start up launched in early 2022, but Gupta comes with nearly a decade of experience in helping clients find financial solutions with their homebuying and business needs. With Funding Station, Gupta and his partners are looking to continue to help people secure financing and they specialize in finding solutions for the more difficult cases where things may not be as straightforward.

Gupta reflects that “things in the housing marketing had been moving in an upwards fashion until about February 2022 when it hit its peak. Then, almost coincidentally before the rate increases, we started to see the market coming back to levels it was at, prior to the steep increases.”

According to the CMHC, “From its peak in February 2022 to last August, the seasonally adjusted average MLS® price for the entire country fell by 15.6%.” Then, in March 2022, the Bank of Canada began implementing rate increases, which impacted the qualifying rates for individuals seeking mortgages.

Regarding the Bank of Canada’s increases, Gupta comments that “the rate changes have or will have multiple impacts. First, the rate changes definitely made qualification more difficult for people looking to buy as the thresholds have increased, in terms of how much income you’re required to make in order to qualify for certain amounts of financing. When people are qualifying for lesser amounts of mortgages, inevitably, the prices of homes will come down because there’s less affordability for people who would’ve otherwise been able to buy at a higher price. Next, the rate hikes immediately made people hesitant to buy, but it didn’t have any fundamental changes on the market, other than bringing about that uncertainty. As well, once the existing mortgages expire, if people don’t examine their options, they may be facing significant increases in their payments going forward.”

That said, Gupta stresses that “locking down a preapproval before you start shopping, especially in the current market, is honestly the first thing anyone should do so you know what’s in your budget. This is particularly important because usually, offers to buy a property that are submitted with financing conditions typically expire in a few days and if you aren’t sure what you qualify for or what you’ll be able to afford to buy, then you might be going on a lot of showings for properties you may not be able to afford. And so, to avoid disappointment, it’s important to secure a preapproval.”

When it comes time to choose between a variable or fixed mortgage rate, Gupta votes for the variable option. “Even though in the short term the rate increases may continue, potentially as soon as October 2022, it is likely that we are nearing the end of the rate hike cycle. In that case, a variable rate would allow you to benefit from the eventual and seemingly inevitable rate downswing when it happens.” However, Gupta adds that “clients should consider their budget and if stability is a high priority, then it may be better to go with a fixed rate.”

As people continue to hesitantly shop, they are feeling the pressures of the rate increase and continue to wonder if the end is near. Gupta explains “we knew that the rate was going to go up. In September, there was speculation that the increase would be the end, but as we know, more are on the horizon. This is because, generally, when you’re trying to curb inflation, you want to bring the rate up to what is considered a neutral point and that’s usually when the interest rates will match the rate of inflation. In the short term, these rate increases have already had an effect on the housing market, in terms of cooling it by way of dropping the prices, decreasing the sales volume, and increasing the inventory of what’s available for people to buy. In the long-term, we will have to see if we go into a full-blown recession or if it will be a stagnant period, followed by another increase, which is what’s happened in the past.”

Despite the doom and gloom that grows stronger with each rate hike, the 2022 Federal Budget did include some changes that may lift the spirits of new homebuyers. For example, Global News reports that the “…government is planning to spend $10.14 billion on housing over the next five years.”

First, in 2023, the Tax-Free First Home Savings Account (TFFHSA) will be introduced and allow individuals “…to save $8,000 per year to a maximum of $40,000 per person towards the purchase of a first home,” describes Global News. Next, the First-Time Home Buyers’ Tax Credit has been raised from $5,000 to $10,000, and this will be applied “…retroactively to any homes purchased after Jan. 1, 2022,” notes Global News. The budget also highlights that the limited supply of housing is problematic. As such, Global News writes that “the budget lays out plans to double the annual pace of building in the country over the next decade, up from the current 200,000 units per year.”

With these changes in mind, there seems to be hope for homebuyers in the years to come. But, for those who can’t or don’t want to wait five years, I asked Gupta the question that has probably caused a lot of hopeful homebuyers and sellers to lose sleep: is it a good time to buy or sell?

Gupta shares that “we know that it’s not a seller’s market anymore. Therefore, if you’re looking to sell, chances are your home will be on the market for longer and you may not get the price you’re looking for. Generally speaking, when interest rates go up, it usually provides better buying opportunities because of the affordability and the fact that prices are down. As well, if you want to anticipate that rates won’t stay this high that long, and in fact, in the long-term maybe come back down once things are sorted out with the supply chain crisis and things like that, buying in a high interest rate environment actually makes more sense than buying in a low interest rate environment because you give yourself the potential to benefit when the rates do drop eventually. That’s what happened with the boomers, if you think about it, they bought when the interest rates were anywhere from 10-15% and when the rates dropped, the properties they had purchased at $100K or $200K became worth $1.5-2M. One of the key factors contributing to this shift would be the ability of individuals to qualify for greater mortgage amounts because of the reduced stress test thresholds. Securing a mortgage was more affordable due to the lower interest rates, and in turn, the value of the homes went up, and homebuyers ultimately benefited from that increase.”

What’s going on in the United States?

Like Canada, inflation is a major issue in the United States after peaking at 9.1% in June 2022. To help regulate inflation, the Federal Reserve, the central bank in America, has also implemented 3 interest rate increases, bringing the rate to 3.25% in September. However, further increases are expected, which would bring the interest rate “…to 4.25 percent to 4.5 percent, according to The Washington Post.

President Joe Biden is responsible for the introduction of The Inflation Reduction Act, which will offer some reprieve from the rising costs of living. The Inflation Reduction Act will “…lower the cost of prescription drugs — including cancer medications, blood thinners and insulin,” notes NBC News, and may be more beneficial for those on Medicare.

Here’s a professional opinion on the American housing market:

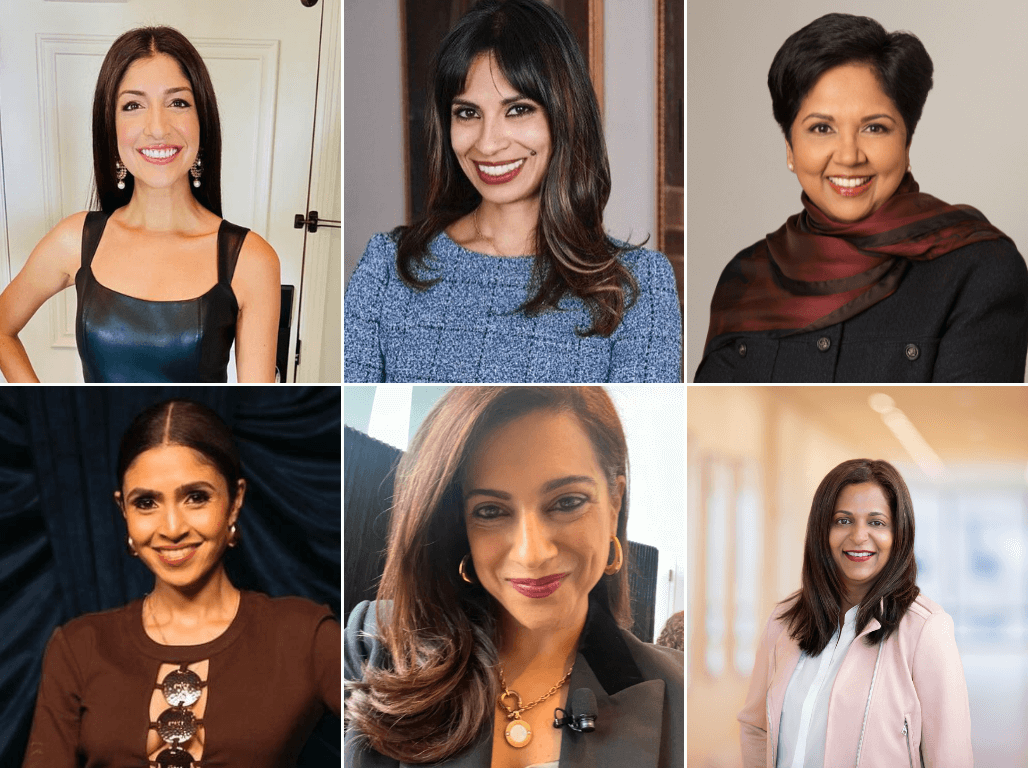

To get a deeper perspective on the American housing market, I connected with former ANOKHI LIFE’s Style Editor, Monika Bhondy, who has been a member of the National Association of REALTORS® since 2016. Bhondy is also a Certified Luxury Home Marketing Specialist® and Certified Staging Consultant after “catching an interest in the business of ‘flipping houses,’ which I had been introduced by my husband and brother-in-law (business partner), who at the time had a bunch of successful projects under their belt.”

Despite how serious the situation feels today, historically speaking, Bhondy shares that “we are still in a better situation with lower rates compared to a few decades ago.” For instance, CNN reports that in September 1981, a 30-year fixed-rate mortgage was at a whopping double-digit high of 19%.”

So should buyers and sellers be panicking?

With years of experience under her belt, Bhondy shared her informed insights that will calm your frazzled nerves and explains what folks can expect when buying or selling a home at this time.

When looking to sell your home Bhondy can’t stress enough how important the details are. “As a seller be prepared to ‘put in the work!’ You’ve heard the saying, ‘first impressions are EVERYTHING,’ so make it count! Although there’s not as much competition, you still need to be irresistible for a buyer to want to bite, especially with today’s rising interest rates. That goes for both the inside and outside of your home. I have one word for sellers: immaculate. This is not the time to let things slide. You and your home need to be on top of your game. Be prepared for longer market time, longer inspection periods, closing dates, and contingencies, and be ready to negotiate. Have an agent in your corner that is a master in the art of negotiation.”

That said, for buyers things are a little different. Bhondy believes that “buyers can expect to see prices drop as homes find themselves on the market longer. Therefore, even though your rate may be higher, your purchase price will be lower. As a buyer take note: interest rates are not the end-all, be-all in real estate. Yes, you’re seeing higher rates, but you’re also seeing higher rent prices too. Depending on your personal circumstances, it may be worthwhile to pay a little more per month to own than to rent. Plus, there’s the option of refinancing. If you’re unhappy with the interest rates now, you can refinance your mortgage when rates are lower.”

All hail refinancing, am I right?

As seen in Canada, high interest rates seem to be scaring people into sitting on the sidelines of the real estate market as they wait to see what happens next. However, Bhondy disagrees with this approach. “If you have the means, go for it! We’re still in a low inventory market, so for sellers that means you still have less competition out there. Your homes are wanted and you’re still in demand, just be aware of the changes taking place today: it is no longer that seller’s market. If you need to unload for whatever reason, don’t be afraid to. Instead, you will just have to brush up on your negotiating skills to ensure they are razor sharp!”

Meanwhile, Bhondy notes that “buyers can snag a cheaper home and simply refinance later on once interest rates drop.”

For buyers, when it comes to choosing between a fixed or variable rate, Bhondy recommends “taking the variable, if you’re planning on living there short-term. For example, a 3-year adjustable-rate mortgage (ARM) would allow a buyer to take advantage of a lower interest rate. However, if you’re planning on owning the property long-term (5+ years), it might be better to take the fixed and you can always refinance when rates are lower.” That said, these decisions always come down to your financial situation, so be sure to consult a financial professional to make the best choice for your circumstances.

And, of course, no conversation about interest rates would be complete without addressing the elephant in the room: the recession.

Bhondy explains that “I do not believe we will be in a full-blown recession as a lot of this hysteria is election-related. Once the election settles, retail sales should pick up and earnings will be strong. Employment data is still very strong and will remain so. There will be some turbulence, but we should be back on a steady course of growth in Q1 2023.”

Bottom line, Bhondy urges buyers and sellers alike “not to wait because rates are expected to rise further.”

What’s next?

In Canada, as of September 2022, there has been a dip with inflation now sitting at 6.9%. Meanwhile, in the US, the inflation rate is currently sitting at 8.2%. However, lowering the CPI to 2% in Canada and 3.2% in the US, and increasing purchasing power will take time. With a recession looming like a dark cloud over our heads, as Gupta expressed, it remains to be seen whether it will be a full-blown downturn or if things will level out after a period of stagnation.

So whether you are thinking of buying, selling or renting, there are many options out there for you while we all ride out these times of austerity. Yes, the bubble is definitely looking to pop, but sometimes it may reveal a pleasant surprise.

Main Image Photo Credit: www.ig.ca

Devika Goberdhan | Features Editor - Fashion

Author

Devika (@goberdhan.devika) is an MA graduate who specialized in Political Science at York University. Her passion and research throughout her graduate studies pushed her to learn about and unpack hot button issues. Thus, since starting at ANOKHI in 2016, she has written extensively about many challe...